astro-athena.ru Gainers & Losers

Gainers & Losers

Paypal $10 Reward Email

Get a $10 reward on your first purchase using PayPal on Google Play. Make a purchase with an on-store price of $5 or greater to redeem. PayPal, ACH, direct deposit. Choice products. Selectable Your reward will be delivered via email with instructions for claiming your Visa prepaid card. ITS A SCAM!!! There is no offer of $10 reward by Paypal. I contacted Paypal about it 2 days ago about being sent that Email with an offer of a $10 cash reward. (4) After your purchase, PayPal will email a $10 reward to be saved to your PayPal wallet. Check your account activity and more. Terms apply. Make a purchase. ITS A SCAM!!! There is no offer of $10 reward by Paypal. I contacted Paypal about it 2 days ago about being sent that Email with an offer of a $10 cash reward. PayPal Rewards is PayPal's rewards program that lets you earn points when you take advantage of offers available to you when you use PayPal and PayPal Honey (“. Get a free a PayPal $10 by taking surveys, shopping, playing games, and watching videos. PayPal is offering select customers $10 free. An email has been sent out to eligible customers, but you can also check the promotions page to see if you are. The headline claim in the body of the email stated: "We're giving you £10 to use online with PayPal" followed by a clickable"Save Offer" button. The fact the. Get a $10 reward on your first purchase using PayPal on Google Play. Make a purchase with an on-store price of $5 or greater to redeem. PayPal, ACH, direct deposit. Choice products. Selectable Your reward will be delivered via email with instructions for claiming your Visa prepaid card. ITS A SCAM!!! There is no offer of $10 reward by Paypal. I contacted Paypal about it 2 days ago about being sent that Email with an offer of a $10 cash reward. (4) After your purchase, PayPal will email a $10 reward to be saved to your PayPal wallet. Check your account activity and more. Terms apply. Make a purchase. ITS A SCAM!!! There is no offer of $10 reward by Paypal. I contacted Paypal about it 2 days ago about being sent that Email with an offer of a $10 cash reward. PayPal Rewards is PayPal's rewards program that lets you earn points when you take advantage of offers available to you when you use PayPal and PayPal Honey (“. Get a free a PayPal $10 by taking surveys, shopping, playing games, and watching videos. PayPal is offering select customers $10 free. An email has been sent out to eligible customers, but you can also check the promotions page to see if you are. The headline claim in the body of the email stated: "We're giving you £10 to use online with PayPal" followed by a clickable"Save Offer" button. The fact the.

S dollars) will be deposited into your PayPal account. 4. (4) After your purchase, PayPal will email a $10 reward to be saved to your PayPal wallet. You can. How it Works: During the Offer Period, Eligible Participants must make their first Eligible Purchase of $20 USD or more to earn $10 USD (“Reward”). Reward. Gift card denominations range from $10 to $ Every prepaid Mastercard® Gift Card design can be sent as an eGift Card by email or a plastic Gift Card by. Check out with PayPal on Google Play, YouTube, and the Google Store. Find out how to add money to Google Pay, link your PayPal account, and more. When your friend sends or spends $5+ within 30 days of signup, you both can earn a $10 reward to use when you check out with PayPal. img FAQs. (3) Make a purchase on Google Play of $5 or more using PayPal. (4) After your purchase, PayPal will email a $10 reward to be saved to your PayPal wallet. 8. Fake Payment Confirmations or Invoices You receive an email that appears to be from PayPal confirming that your order has been paid for or with an attached. For business accounts, the Reward will only be visible during checkout and on the purchase transaction receipt(s). If you are still unable to. If you're eligible for the promotion, we send an email explaining how to claim the reward along with the Terms and Conditions of the offer. Earn $10 each time a. Faked sender email address Fraudsters can easily fake the “friendly name” in the sender's email address. For example, an email can appear to be from “PayPal. Get a $10 reward when you make your first QR code payment of $20 or more at CVS® stores. An email sent by payment giant PayPal which promised customers a reward of £10 for using their account did not make it clear enough that not everyone would. How it Works: During the Offer Period, Eligible Participants must make their first Eligible Purchase of $20 USD or more to earn $10 USD (“Reward”). Reward. S dollars) will be deposited into your PayPal account. 4. (4) After your purchase, PayPal will email a $10 reward to be saved to your PayPal wallet. You can. “Redemption Period”: Starts on the day an Eligible Participant receives their Reward (“Reward”) via PayPal email and ends 30 days thereafter. Reward must be. Terms apply. Make your first purchase of at least $3 by 12/25/23 using PayPal on Google Play. You will receive an email notification prompting you to save. Promotion ends on June 30, You can also choose where to post your topic under Location. Com]. (4) After your purchase, PayPal will email a $10 reward to. claim your 10 reward paypal (4) After your purchase, PayPal will email a $10 reward to be saved to your PayPal wallet. If you need further assistance. Hello, John. Once you have qualified for the $10 reward, it will be automatically applied toward your next purchase within PayPal. The $ You will see a window titled "Redeemed payout," with a note that says, "We're sending the money to your PayPal account." You will also receive an email with the.

Top Dog Insurance Companies

The best pet insurance ever by Nationwide®. Plans covering wellness, illness, emergency & more. Use any vet and get cash back on eligible vet bills. Compare Pet Insurance Companies ; Routine Care Coverage ; Optional Vet Direct Pay ; 24/7 Pet Helpline ; No Upper Age Limits on Accident & Illness Plans. Embrace Pet Insurance was named the top Pet Insurance Provider by Forbes in The company reports that it paid out 92% of the claims submitted in and. Canada. Fetch Pet Insurance · Furkin Pet Insurance · Petango · Pethealth Inc. PetYellow · Pets Plus Us · 24PetWatch Pet Insurance Programs · PHI Direct. Discover how much MetLife's award-winning pet insurance could save you on emergency or routine care for your pet. Click for a free quote or call. Compare quotes from popular dog insurance companies and enroll in minutes. We offer FREE, expert advice to help you choose the best health plan for your. Nationwide has been in the pet insurance business since , when it acquired Veterinary Pet Insurance, the oldest pet insurance company in the United. Lemonade Pet Insurance: everything you love about Lemonade now for cats and dogs. Instant claims and a digital experience driven by social good.:heart. Pawlicy Advisor is the leading independent marketplace for finding the best coverage for your pet at the lowest rate. Join 2,,+ insured dogs and cats. The best pet insurance ever by Nationwide®. Plans covering wellness, illness, emergency & more. Use any vet and get cash back on eligible vet bills. Compare Pet Insurance Companies ; Routine Care Coverage ; Optional Vet Direct Pay ; 24/7 Pet Helpline ; No Upper Age Limits on Accident & Illness Plans. Embrace Pet Insurance was named the top Pet Insurance Provider by Forbes in The company reports that it paid out 92% of the claims submitted in and. Canada. Fetch Pet Insurance · Furkin Pet Insurance · Petango · Pethealth Inc. PetYellow · Pets Plus Us · 24PetWatch Pet Insurance Programs · PHI Direct. Discover how much MetLife's award-winning pet insurance could save you on emergency or routine care for your pet. Click for a free quote or call. Compare quotes from popular dog insurance companies and enroll in minutes. We offer FREE, expert advice to help you choose the best health plan for your. Nationwide has been in the pet insurance business since , when it acquired Veterinary Pet Insurance, the oldest pet insurance company in the United. Lemonade Pet Insurance: everything you love about Lemonade now for cats and dogs. Instant claims and a digital experience driven by social good.:heart. Pawlicy Advisor is the leading independent marketplace for finding the best coverage for your pet at the lowest rate. Join 2,,+ insured dogs and cats.

Insurance is underwritten and issued by Independence American Insurance Company (rated A- "Excellent" by A.M. Best) with offices at N. Scottsdale Rd. comparing pet insurance plans for your cat or dog ; Yes, No, Yes, No ; Yes, No, Yes, No. Truepanion · American Pet Insurance Company, () ; Pet Partners AKC Pet Health Care, American Insurance Company, () ; Healthy Paws Pet. Lemonade Pet Insurance: everything you love about Lemonade now for cats and dogs. Instant claims and a digital experience driven by social good.:heart. If Pet Insurance Review Doesn't Sell Insurance, How does it make money? We get a fee from the provider when we assist you in purchasing a policy for your pet. Any one you like! Some pet health insurance providers limit you to a “veterinary network” of animal hospitals, but we believe your pet deserves the best care. Pets Best offers two types of pet insurance plans, one for accidents only and another that covers both accidents and illnesses (the BestBenefit plan). With a. If your dog or cat has a lot of expensive needs and you're concerned about coverage gaps, Pumpkin is a solid provider to cover all of the angles. Plus there are. Pets Best offers two types of pet insurance plans, one for accidents only and another that covers both accidents and illnesses (the BestBenefit plan). With a. What's the best pet insurance coverage for your pet and budget? View side-by-side plan details and see how different pet insurance companies compare. Truepanion · American Pet Insurance Company, () ; Pet Partners AKC Pet Health Care, American Insurance Company, () ; Healthy Paws Pet. comparing pet insurance plans for your cat or dog ; Yes, No, Yes, No ; Yes, No, Yes, No. Wag! Compare is a free pet insurance comparison service* and we help you compare the top insurance providers to get the best possible deal. You can find the. ASPCA Pet Insurance Review · Banfield Wellness Plan Review · Bivvy Pet Insurance Review · Costco Pet Insurance Review · Embrace Pet Insurance Review · Fetch By The. Canada. Fetch Pet Insurance · Furkin Pet Insurance · Petango · Pethealth Inc. PetYellow · Pets Plus Us · 24PetWatch Pet Insurance Programs · PHI Direct. The best pet insurance ever by Nationwide®. Plans covering wellness, illness, emergency & more. Use any vet and get cash back on eligible vet bills. Insurance is underwritten and issued by Independence American Insurance Company (rated A- "Excellent" by A.M. Best) with offices at N. Scottsdale Rd. Pet insurance from Embrace saves you up to 90% back on vet bills from unexpected illness and medical expenses. From dog and cat insurance to wellness. We surveyed pet owners and analysed over cat and dog policies to reveal which companies offer the best pet insurance.

Interest Calculator For Mortgage Loan

This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. The bank you are working with has offered you a fixed interest rate of % on a year, $, loan. You choose to make monthly payments. We will use the. Amortization is the process of paying off a debt over time in equal installments. To use our amortization calculator, type in a dollar figure under “Loan. The Payment Calculator can determine the monthly payment amount or loan term for a fixed interest loan. To estimate your monthly mortgage payment, simply input the purchase price of the home, the down payment, interest rate and loan term. Use our mortgage payment calculator to estimate how much your payments could be. Calculate interest rates, amortization & how much home you could afford. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. Mortgage, Equipment Loan, Equipment Lease. Mortgage Equipment Loan Equipment Lease. Mortgage Calculator Interest. $6, Total Amount. (Principal +. This calculator allows you to factor in the sale price, interest rate, mortgage terms and down payment to compute exactly how much you'll owe on a monthly basis. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. The bank you are working with has offered you a fixed interest rate of % on a year, $, loan. You choose to make monthly payments. We will use the. Amortization is the process of paying off a debt over time in equal installments. To use our amortization calculator, type in a dollar figure under “Loan. The Payment Calculator can determine the monthly payment amount or loan term for a fixed interest loan. To estimate your monthly mortgage payment, simply input the purchase price of the home, the down payment, interest rate and loan term. Use our mortgage payment calculator to estimate how much your payments could be. Calculate interest rates, amortization & how much home you could afford. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. Mortgage, Equipment Loan, Equipment Lease. Mortgage Equipment Loan Equipment Lease. Mortgage Calculator Interest. $6, Total Amount. (Principal +. This calculator allows you to factor in the sale price, interest rate, mortgage terms and down payment to compute exactly how much you'll owe on a monthly basis.

Original loan term, years ; Interest rate ; Remaining term. years months ; Repayment options: Payback altogether. Repayment with extra payments. per month per year. If you make more frequent payments, you'll pay less interest and be mortgage-free faster. Get financial protection for your CIBC Mortgage Loan if you can't. calculator to calculate estimated monthly payments and rate options for a variety of loan terms How does my credit rating affect my home loan interest rate? Calculate your home mortgage debt and display your payment breakdown of interest paid, principal paid and loan balance. Use this calculator for basic calculations of common loan types such as mortgages, auto loans, student loans, or personal loans. Your monthly mortgage payment depends on a number of factors, like purchase price, down payment, interest rate, loan term, property taxes and insurance. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown; Schedule. To learn what your monthly payment will be based on your home price, interest and more, use our mortgage calculator. Mortgage Information. Original Loan Amount. Home Price · Down Payment · Loan Amount · Interest Rate · Start Date · Home Insurance · Taxes · HOA Dues. Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. Payment Calculator for Mortgages, Car Loans and Other Term Loans. Use the form below to calculate. Enter your loan information. mortgage loan insurance premium you have to pay. Interest Rate: %. WCAG Placeholder. Annual interest rate for this mortgage. Amortization Period: 1 Year, 2. Loan Payment Calculator · Debt Consolidation Calculator · Compare Lines of Calculate your mortgage payments based on how much you borrow, your interest rate. Mortgage payment formula ; P · Principal loan amount ; r, Monthly interest rate: Lenders provide you an annual rate so you'll need to divide that figure by 12 (the. Use this calculator to quickly see how much interest you will pay, and your principal balances. You can even determine the impact of any principal prepayments! Use the calculator below for mortgage loans in the United States. House Value. Down Payment. Loan Term, years. Interest Rate. Mortgage Calculator. Loan Amount. Interest Rate. mortgage payment — principal or interest — at various times throughout the loan term. How do you calculate amortization? To use the mortgage amortization. This calculator will compute an interest-only loan's accumulated interest at various durations throughout the year. These amounts reflect the amount which would.

Settling Charged Off Debt

Debt settlement programs are typically offered by for-profit companies to people with significant credit card debt. The companies negotiate with your creditors. Contact the creditor: Reach out to the original creditor to discuss your options. · Negotiate a settlement: If you can't pay the full amount owed, try. The first thing you need to do is gather all the information about the charge-off debt. That includes how much is owed, how old the debt is, and who currently. You could pay off your debt much sooner. · You'll only pay a fraction of what you owe. · You can avoid pesky fees charged by debt settlement companies. · You can. So, if you can't afford to pay your charged-off debt, debt settlement is a great option to consider. We wanted to learn more about how to negotiate debt. Settling your credit card debt typically means that you negotiate an agreement to repay a portion of your balance, because you are facing hardships that. Typical pre-charge-off settlements amount to about 50 cents on the dollar, which is right in the center of the typical debt settlement range from 40 to 60 cents. A 35% discount? · Bear in mind, whatever they settle for, you are liable for taxes on the difference, For instance, if you settle a $5, debt. Your first option is to request the charge-off be removed from your credit report in exchange for agreeing to pay the debt. You can either pay in full or set up. Debt settlement programs are typically offered by for-profit companies to people with significant credit card debt. The companies negotiate with your creditors. Contact the creditor: Reach out to the original creditor to discuss your options. · Negotiate a settlement: If you can't pay the full amount owed, try. The first thing you need to do is gather all the information about the charge-off debt. That includes how much is owed, how old the debt is, and who currently. You could pay off your debt much sooner. · You'll only pay a fraction of what you owe. · You can avoid pesky fees charged by debt settlement companies. · You can. So, if you can't afford to pay your charged-off debt, debt settlement is a great option to consider. We wanted to learn more about how to negotiate debt. Settling your credit card debt typically means that you negotiate an agreement to repay a portion of your balance, because you are facing hardships that. Typical pre-charge-off settlements amount to about 50 cents on the dollar, which is right in the center of the typical debt settlement range from 40 to 60 cents. A 35% discount? · Bear in mind, whatever they settle for, you are liable for taxes on the difference, For instance, if you settle a $5, debt. Your first option is to request the charge-off be removed from your credit report in exchange for agreeing to pay the debt. You can either pay in full or set up.

The process typically takes three to four years. Note that debt settlement companies can only legally charge you fees once they have resolved your debt — and. You must have the money to pay off the debt at the negotiated amount. Your credit score temporarily drops, if it hasn't already, due to late payments. Taxes may. Negotiating, or settling, your debt means paying it off for much less than what you owe to your creditor. Just how much you pay is agreed upon by both you and. Note that in both circumstances, the debt is not forgiven. You are still responsible for paying off your debts, unless you've received a discharge in bankruptcy. You will still be responsible for paying off charged-off accounts until you have paid them, settled them with the lender, or discharged them through bankruptcy. That's when a credit card company writes off a debt, counting it as a loss for accounting purposes. But even after a charge-off, credit card companies can still. The balance owed is reduced, sometimes by as much as 50%; It's a way to avoid bankruptcy for those who can pay the settlement amount. Once the debt is paid off. Cons of Paying Off Old Credit Card Debt · Resetting the Clock · Letting Your Debt Charge-Off · Covering the Cost of Credit Errors Twice. Usually, debt settlement is only used for credit card debt, but some agencies may market settlement services for other debts, like student loans, medical bills. You are still legally obligated to pay the debt. If you've fallen behind on payments for one of your credit accounts, you may be notified – or see on your. Your first option is to request the charge-off be removed from your credit report in exchange for agreeing to pay the debt. You can either pay in full or set up. For credit cards, paying in full keeps your open account in good standing and clears away any remaining “charge off” debt you owe on a closed account. Is it. Will setting up a payment arrangement for an account in collections improve my credit score? You can set up a payment arrangement if you can't afford to pay off. The next step is to set up affordable monthly payments for you to pay off the rest. You could see your accounts resolved in as little as months. If you. As we explained above, debt settlement companies will advise you to stop making payments. If your debts are to charge-off status yet, this means you're. Create a settlement plan · You can make a lump-sum payment. · You can make monthly payments, which is easier and cheaper than a garnishment. (Please note that. Keep in mind that debt-settlement plans may not stop creditors from charging interest, late fees, or other penalties on outstanding debts, and do not prevent. Affirm provides notices of late payments and the potential for charge-off before the charge-off occurs, and will also notify you when your loan is charged off. Settling your credit card debt typically means that you negotiate an agreement to repay a portion of your balance, because you are facing hardships that.

What Should I Learn To Become A Game Developer

A degree in Computer Science or a specialized Game Development program is one of the most common and beneficial paths for aspiring game developers. These. For systems engineering, more of the hardcore technology side and C++ — that's a bit harder to get into. You should for sure make games or make demos of some. After my bachelor, did Computer Science, Micro-Electronics and finally Computer Graphics. Applied to a mid-size (back then) game studio to do my. The computer science world is vast, but if you'd like to be a Game Developer, you need to know the basics. Learn the most used computer languages such as Python. Learning about game development fuels your imagination and ability to develop new ideas that align with the target audience. Game development training teaches. A Bachelor's degree in software development is the minimum requirement to enter the industry. In addition, a degree adds credibility to your passion for gaming. A Bachelor's degree in software development is the minimum requirement to enter the industry. In addition, a degree adds credibility to your passion for gaming. Software Engineering skills. As a game programmer, you should become an expert in all aspects of making software. Further areas of focus should be knowledge of. I suggest learning Mathematics, Physics, C++ to start, then you can Learn Open Gl (3D, Rasterisation, Rendering), Physics programming. which. A degree in Computer Science or a specialized Game Development program is one of the most common and beneficial paths for aspiring game developers. These. For systems engineering, more of the hardcore technology side and C++ — that's a bit harder to get into. You should for sure make games or make demos of some. After my bachelor, did Computer Science, Micro-Electronics and finally Computer Graphics. Applied to a mid-size (back then) game studio to do my. The computer science world is vast, but if you'd like to be a Game Developer, you need to know the basics. Learn the most used computer languages such as Python. Learning about game development fuels your imagination and ability to develop new ideas that align with the target audience. Game development training teaches. A Bachelor's degree in software development is the minimum requirement to enter the industry. In addition, a degree adds credibility to your passion for gaming. A Bachelor's degree in software development is the minimum requirement to enter the industry. In addition, a degree adds credibility to your passion for gaming. Software Engineering skills. As a game programmer, you should become an expert in all aspects of making software. Further areas of focus should be knowledge of. I suggest learning Mathematics, Physics, C++ to start, then you can Learn Open Gl (3D, Rasterisation, Rendering), Physics programming. which.

Get a degree in software engineering or computer science. A lot of this stuff you can learn online, but most development studios really want. After my bachelor, did Computer Science, Micro-Electronics and finally Computer Graphics. Applied to a mid-size (back then) game studio to do my. Software Engineering skills. As a game programmer, you should become an expert in all aspects of making software. Further areas of focus should be knowledge of. Guide to become a great Game Developer · 1. Start with your education · 2. Expand your knowledge of programming · 3. Take online courses and digital certifications. Typically, individuals looking to become video game developers should achieve at least a bachelor's degree in software engineering, or a related field. Game Developers interact with computers daily, and have strong knowledge of computer programming, as well as sound and visual design, and 2D and 3D animation. The industry does not set specific education requirements for video game designers. Still, many employers prefer applicants with a college degree. A bachelor's. What Are the Education Requirements for a Game Developer? Game developers often take the route of earning a bachelor's degree in a field like computer science. A degree in Game Development offers a structured and comprehensive learning experience, covering a range of topics from programming languages and software. What Do Video Game Developers Do? · Video Game Developer Skill Requirements · 1. Communication Skills · 2. Problem-solving / Solution-finding Skills · 5. Math-. Once you know how to become a game developer in its entirety, however, you will have to learn C++. It is the industry-standard programming language in game. There are no formal education requirements for video game designers. However, many video game companies prefer job applicants with a bachelor's degree and. What Education Does a Video Game Designer Need? A bachelor's degree in software engineering is an ideal place to start if you want to become a video game. Educational requirements. Many game development and publishing companies look for candidates with a bachelor's degree in computer science or related field. Some. Typically, individuals looking to become video game developers should achieve at least a bachelor's degree in software engineering, or a related field. Learning about game development fuels your imagination and ability to develop new ideas that align with the target audience. Game development training teaches. I suggest learning Mathematics, Physics, C++ to start, then you can Learn Open Gl (3D, Rasterisation, Rendering), Physics programming. which. 2. What skills are required to become a game developer? Game developers need a blend of creative and technical skills, involving design, coding, and testing to bring interactive video games to life. What are the Most Important Skills of Game Developers? · Coding Skills: Learn C, C++, Java, and Python, to have a versatile hand that can use any programming.

Should I Buy Tesla Stock Today

In the current month, TSLA has received 51 Buy Ratings, 40 Hold Ratings, and 19 Sell Ratings. TSLA average Analyst price target in the past 3 months is $ Delivery timing varies by model, location and current availability. Note: The total amount for your final payment must come from a single account. Therefore, if your Tesla stock is greater than 20% of your entire portfolio, I recommend taking some profits down to 20%. But if Tesla stock is well under 20%. Find new and used Tesla cars. Every new Tesla has a variety of configuration options and all pre-owned Tesla vehicles have passed the highest inspection. Tesla's market capitalization is $ B by B shares outstanding. Is Tesla stock a Buy, Sell or Hold? Tesla stock has received a consensus rating of buy. Tesla is not a profitable company. In fact, Tesla lost almost a billion dollars in and in The great concern with Tesla is whether it can survive long. Should I buy Tesla (TSLA)? Use the Zacks Rank and Style Scores to find out is TSLA is right for your portfolio. Yes, you still get the same percentage of gains, just in less volumes. If that's all you can invest, go for it if you like the stock, this. Tesla (TSLA) Receives a Buy from Bank of America Securities by TipRanks Sep 13 am ET Buy Rating on Tesla: Sustained Growth and Strong Market Position. In the current month, TSLA has received 51 Buy Ratings, 40 Hold Ratings, and 19 Sell Ratings. TSLA average Analyst price target in the past 3 months is $ Delivery timing varies by model, location and current availability. Note: The total amount for your final payment must come from a single account. Therefore, if your Tesla stock is greater than 20% of your entire portfolio, I recommend taking some profits down to 20%. But if Tesla stock is well under 20%. Find new and used Tesla cars. Every new Tesla has a variety of configuration options and all pre-owned Tesla vehicles have passed the highest inspection. Tesla's market capitalization is $ B by B shares outstanding. Is Tesla stock a Buy, Sell or Hold? Tesla stock has received a consensus rating of buy. Tesla is not a profitable company. In fact, Tesla lost almost a billion dollars in and in The great concern with Tesla is whether it can survive long. Should I buy Tesla (TSLA)? Use the Zacks Rank and Style Scores to find out is TSLA is right for your portfolio. Yes, you still get the same percentage of gains, just in less volumes. If that's all you can invest, go for it if you like the stock, this. Tesla (TSLA) Receives a Buy from Bank of America Securities by TipRanks Sep 13 am ET Buy Rating on Tesla: Sustained Growth and Strong Market Position.

Fewer Consumers Are Planning to Buy EVs. Is It Time to Sell Rivian and Tesla Stocks? With EV growth slowing, what should investors do with the EV stocks? Motley. If you want to potentially buy a stake in history then buying a share of Tesla could be very good for you. If you're looking for short term. As of 2 March, MarketBeat had the consensus recommendation from analysts for Tesla stock stood at 'hold', with 21 out of 36 analysts rating the stock a buy, Mostly positive signals in the chart today. The Tesla stock holds buy signals from both short and long-term Moving Averages giving a positive forecast for the. TSLA | Complete Tesla Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Recent price changes and earnings estimate revisions indicate this would not be a good stock for momentum investors with a Momentum Score of F. Style Scorecard. Investors who bought Tesla stock in late are near breakeven, while those who purchased at the peak less than a year later face over a 40% loss. Ask A.I. Tesla Inc TSLA:NASDAQ ; after hours icon After Hours: Last | AM EDT. quote price arrow down (%) ; Volume. , Investors who bought Tesla stock in late are near breakeven, while those who purchased at the peak less than a year later face over a 40% loss. Ask A.I. Tesla stock last closed at $, up % from the previous day, and has decreased % in one year. It has overperformed other stocks in the Auto. That's not true, it's a volatile stock. I have never sold any of stock for 4 years now, just bought when I have spare money. It's been working. Is Tesla Stock a good buy in , according to Wall Street analysts? The consensus among 31 Wall Street analysts covering (NASDAQ: TSLA). Tesla (TSLA) reported Q2 earnings per share (EPS) of $, missing estimates of $ by %. In the same quarter last year, Tesla's earnings per share. With Tesla's stock at $, investors who are willing to warehouse the shares for at least three to five years could sell Tesla's August $ put for about. Tesla has never declared dividends on our common stock. We intend on retaining all future earnings to finance future growth and therefore, do not anticipate. r/TSLA - Tesla could offer a new feature to help Cybertruck drivers who get buy an equivalent amount of 2x short ETF shares to cover 50 TSLA shares. Tesla's mission is to accelerate the world's transition to sustainable energy. Today, Tesla builds not only all-electric vehicles but also infinitely. The difference is that Tesla isn't like most companies, so at its current price, buying one share of Tesla stock may have more reward potential than risk. Yes. View the real-time TSLA price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. The future of Tesla has exciting potential but remains difficult to predict. TSLA investors should temper their expectations and consider how the potential.

Debt To Income Ratio For House Loan

Standards and guidelines vary, most lenders like to see a DTI below 35─36% but some mortgage lenders allow up to 43─45% DTI, with some FHA-insured loans. Two Types of DTI Ratios: · Should be % of your gross income · Divide the estimated monthly mortgage payment by the gross monthly income. b. According to a breakdown from The Mortgage Reports, a good debt-to-income ratio is 43% or less. Many lenders may even want to see a DTI that's closer to 35%. Front-end debt ratio, sometimes called mortgage-to-income ratio in the context of home-buying, is computed by dividing total monthly housing costs by monthly. Most conventional loan underwriting conditions limit DTI to 45%, but some QM lenders will accept ratios up to 50% if the borrower has compensating factors, such. Manageable: 37 percent to 42 percent; Cause for concern: 43 percent to 49 percent; Dangerous: 50 percent or more. Not sure which debt solution is right for you? How to calculate your debt-to-income ratio · The housing to income ratio equals the sum of your monthly housing payment, divided by current income. · The back-. As a general rule of thumb, it's best to have a debt-to-income ratio of no more than 43% — typically, though, a “good” DTI ratio is below 35%. A good debt-to-income ratio is below 43%, and many lenders prefer 36% or below. Learn more about how debt-to-income ratio is calculated and how you can improve. Standards and guidelines vary, most lenders like to see a DTI below 35─36% but some mortgage lenders allow up to 43─45% DTI, with some FHA-insured loans. Two Types of DTI Ratios: · Should be % of your gross income · Divide the estimated monthly mortgage payment by the gross monthly income. b. According to a breakdown from The Mortgage Reports, a good debt-to-income ratio is 43% or less. Many lenders may even want to see a DTI that's closer to 35%. Front-end debt ratio, sometimes called mortgage-to-income ratio in the context of home-buying, is computed by dividing total monthly housing costs by monthly. Most conventional loan underwriting conditions limit DTI to 45%, but some QM lenders will accept ratios up to 50% if the borrower has compensating factors, such. Manageable: 37 percent to 42 percent; Cause for concern: 43 percent to 49 percent; Dangerous: 50 percent or more. Not sure which debt solution is right for you? How to calculate your debt-to-income ratio · The housing to income ratio equals the sum of your monthly housing payment, divided by current income. · The back-. As a general rule of thumb, it's best to have a debt-to-income ratio of no more than 43% — typically, though, a “good” DTI ratio is below 35%. A good debt-to-income ratio is below 43%, and many lenders prefer 36% or below. Learn more about how debt-to-income ratio is calculated and how you can improve.

Maximum DTI Ratios. For manually underwritten loans, Fannie Mae's maximum total DTI ratio is 36% of the borrower's stable monthly income. The maximum can be. AgSouth Mortgages Home Loan Originator Brandt Stone says, “Typically, conventional home loan programs prefer a debt to income ratio of 45% or less but it's not. The DTI ratio requirement is 41%. Conventional loans. Conventional mortgage loans are the most common type of mortgage. The DTI ratio for conventional loans may. Monthly mortgage payment $1, which includes the taxes and insurance escrowed + HOA dues $35 = $1, · $1, divided by gross monthly income of $6, Most lenders suggest your debt-to-income ratio should not surpass 43%. We think a ratio of 30% or less is what you need to be financially healthy and anything. Most lenders would like your debt-to-income ratio to be under 36%. However, you can receive a “qualified” mortgage (one that meets certain borrower and lender. It is calculated by summing all the debts held (mortgage, car loan, credit cards, credit margins, personal loans, etc.) and dividing by the yearly income . A lender will want your total debt-to-income ratio to be 43% or less, so it's important to ensure you meet this criterion in order to qualify for a mortgage. To calculate your DTI for a mortgage, add up your minimum monthly debt payments then divide the total by your gross monthly income. For example: If you have a. In most cases, a lender will want your total debt-to-income ratio to be 43% or less, so it's important to ensure you meet this criterion in order to qualify for. "A strong debt-to-income ratio would be less than 28% of your monthly income on housing and no more than an additional 8% on other debts," Henderson says. The answer to this question will vary by lender, but generally, a debt-to-income ratio lower than 35% is viewed as favorable meaning you'll have the flexibility. Debt Ratios For Residential Lending. Lenders use a ratio called "debt to income" to determine the most you can pay monthly after your other monthly debts are. In other words, is your income sufficient to manage the monthly mortgage payment as well as your other financial obligations? To figure this out, your lender. If you're applying for a personal loan, lenders typically want to see a DTI that is less than 36%. They might allow a higher DTI, though, if you also have good. It is the percentage of your monthly pre-tax income you must spend on your monthly debt payments plus the projected payment on the new home loan. Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car. A low DTI ratio means you make significantly more money than what you owe each month, so you're more likely to comfortably cover your mortgage payments. A high. To calculate your DTI for a mortgage, add up your minimum monthly debt payments then divide the total by your gross monthly income. For example: If you have a. To get approved for a mortgage from traditional financial institutions, your GDS should be less than 39%, and your TDS should be less than 44%. You have to.

Celebrity Bank Accounts

FIND THE BESTBank AccountsCredit CardsPersonal LoansCar LoansInsuranceProfessionalsToolsAnswersCalculatorsArticles & StudiesMy WalletCredit ScoreMy Identity. banking. A range of flexible and convenient solutions, with a personal delivery of service. See our current account benefits. Celebrity Accountants · 1. Mick Jagger · 2. Robert Plant · 3. Bob Newhart · 4. John Grisham · 5. Janet Jackson · 6. Kenny G · 7. John D. Rockefeller · 8. Thomas J. Some delivery options may not be available for all events. WHY AM I SEEING MULTIPLE CHARGES ON MY BANK/CREDIT CARD ACCOUNT? If you received any kind of error. Assist with opening bank accounts and investment related accounts; Review new Investment documents; Referrals and management of other advisory firms and. Meet the First National Bank Mortgage Loan Officers who are the preferred lenders for Celebrity Homes Select Account. Online Banking, Client Point. accounts, which have million and million followers. Step specifically targets teen users ages 13 to 18 by offering them an FDIC-insured bank account. In this ruse, a scammer pretends to be a celebrity to get personal information from unsuspecting victims. They may create fake social media accounts, send. Will holds be placed on my credit card when I create an onboard account? Celebrity Cruises® doesn't control how long the holds remain, your bank or financial. FIND THE BESTBank AccountsCredit CardsPersonal LoansCar LoansInsuranceProfessionalsToolsAnswersCalculatorsArticles & StudiesMy WalletCredit ScoreMy Identity. banking. A range of flexible and convenient solutions, with a personal delivery of service. See our current account benefits. Celebrity Accountants · 1. Mick Jagger · 2. Robert Plant · 3. Bob Newhart · 4. John Grisham · 5. Janet Jackson · 6. Kenny G · 7. John D. Rockefeller · 8. Thomas J. Some delivery options may not be available for all events. WHY AM I SEEING MULTIPLE CHARGES ON MY BANK/CREDIT CARD ACCOUNT? If you received any kind of error. Assist with opening bank accounts and investment related accounts; Review new Investment documents; Referrals and management of other advisory firms and. Meet the First National Bank Mortgage Loan Officers who are the preferred lenders for Celebrity Homes Select Account. Online Banking, Client Point. accounts, which have million and million followers. Step specifically targets teen users ages 13 to 18 by offering them an FDIC-insured bank account. In this ruse, a scammer pretends to be a celebrity to get personal information from unsuspecting victims. They may create fake social media accounts, send. Will holds be placed on my credit card when I create an onboard account? Celebrity Cruises® doesn't control how long the holds remain, your bank or financial.

Celebrity Home Loans account and enter your preferred checking or savings account info. You can most likely find it by signing into your personal bank account. OPEN BANK ACCOUNT · GET DEBT RELIEF. Search. Subscribe. OPEN BANK ACCOUNT · Banking If you're obsessed with a particular celebrity, you might read every. Actors Federal Credit Union (ActorsFCU) financially empowers the creative community by offering affordable loans, mortgages, and banking services. Will holds be placed on my credit card when I create an onboard account? Celebrity Cruises® doesn't control how long the holds remain, your bank or financial. If you are interested in accounting, you may be familiar with what is known as the Big Four accounting firms. Deloitte, Ernst & Young, KPMG and PwC are the four. Fascinating Exploration of How Celebrities Stay Relevant and Make Bank Your Account · Sell products on Amazon · Recalls and Product Safety Alerts · Customer. Around 60% respondents are having account in public sector banks in last five years. Recently more accounts are opened in private bank compare to public bank. accounts. Audiences leave the show asking “Did these celebrities really Additional support provided by Dime Community Bank, Lisa and Brian Land, Jessica. Banking services and bank accounts are offered by Jiko Bank, a division of Mid-Central National Bank. JSI and Jiko Bank are not affiliated with Public Holdings. Got a question about your Seapass account? You may find exactly Enjoy 75% off your second guest's cruise fare and get bonus savings on select dates. The welcome offer only requires making your first purchase within the first 90 days after opening the account. There is no foreign transaction fee on this card. Celebrity News. Matthew Perry Had $ Million in His Bank Account at the Time of His Death. By Tufayel Ahmed. July 3, Click to share on Facebook. COOGAN TRUST ACCOUNTS · SAG-AFTRA Federal Credit Union · Actors Federal Credit Union · Bank of the West · City National Bank · First Entertainment Credit Union. Regular users were asked to verify their accounts for security purposes, making this arguably the earliest form of phishing. The Nordea Bank Incident. In Mid Penn Bank will be hosting its 9th annual Celebrity Golf Classic in beautiful Hershey, PA! An unforgettable, multi-day event from July 16 – 18, Redeem for cash back as a deposit into Bank of America® checking or savings accounts, for credit to eligible Merrill® accounts including accounts, as a. Celebrity money. Toggle Search. Search Enter search term. Search. Search within The best bank accounts · The best cash Isas · The best credit cards · Save on. savings bonus per room. Find a Cruise. Explore by place Airsea inquiries: [email protected]; Payment & refunds inquiries: [email protected] Donor Egg Bank USA · Cord Blood Banking · Become a Sperm Donor. WHY US? Why Us Returning Users. Account Login. Purchase PurchasePurchase. Your Cart Is.

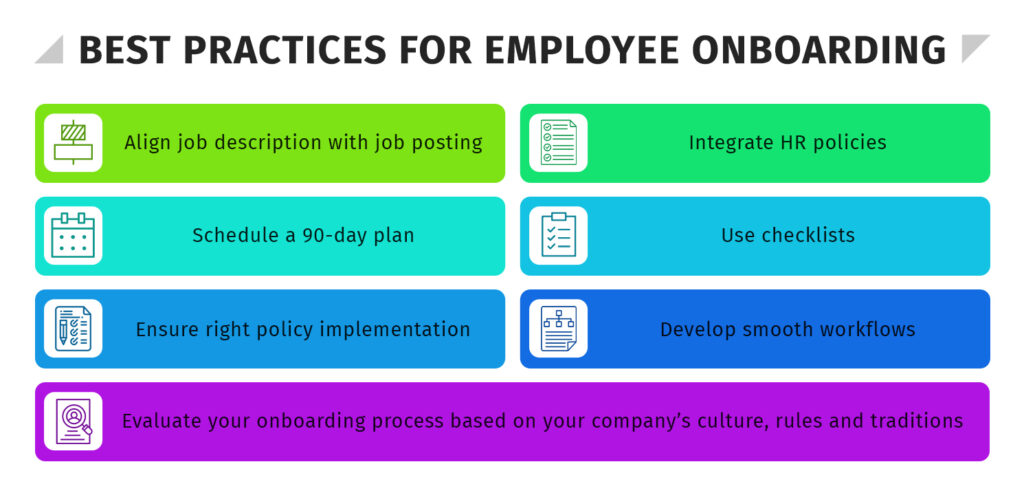

Best Practices Onboarding Employee Orientation

An essential tool for ensuring that all the components of the onboarding process are working together smoothly. This includes things like scheduling training. If possible, try to schedule your most prominent executives as speakers within your new hire orientation schedule. If you are onboarding new employees. 1. Engage new hires with preboarding first · 2. Introduce and demonstrate company values as early as possible · 3. Provide opportunities to connect with other. All staff should greet and show the new hire around to make them feel welcome, accepted, and included from day one. 2. Orientation: Any. New Employee Orientation: 9 Best Practices To Apply · 1. Include realistic information. · 2. Provide general support and reassurance. · 3. Include the. For new hires, employee orientation is a one-time event that welcomes new employees to your company. It's more general in focus. Conversely, employee onboarding. Onboarding Best Practices · Start communicating before your new hire's first day · Set up the employee's workspace before they arrive · Send out a new employee. A strong onboarding and orientation program includes everything from the job to departments to department heads, culture, and procedures. Orientation plan. It should be someone who can do a reasonably good job of answering all the questions the new hire might be a little timid to ask their manager. The idea is to. An essential tool for ensuring that all the components of the onboarding process are working together smoothly. This includes things like scheduling training. If possible, try to schedule your most prominent executives as speakers within your new hire orientation schedule. If you are onboarding new employees. 1. Engage new hires with preboarding first · 2. Introduce and demonstrate company values as early as possible · 3. Provide opportunities to connect with other. All staff should greet and show the new hire around to make them feel welcome, accepted, and included from day one. 2. Orientation: Any. New Employee Orientation: 9 Best Practices To Apply · 1. Include realistic information. · 2. Provide general support and reassurance. · 3. Include the. For new hires, employee orientation is a one-time event that welcomes new employees to your company. It's more general in focus. Conversely, employee onboarding. Onboarding Best Practices · Start communicating before your new hire's first day · Set up the employee's workspace before they arrive · Send out a new employee. A strong onboarding and orientation program includes everything from the job to departments to department heads, culture, and procedures. Orientation plan. It should be someone who can do a reasonably good job of answering all the questions the new hire might be a little timid to ask their manager. The idea is to.

7. Zapier – onboarding for a fully distributed team · Make the new hire feel welcome · Introduce them to Zapier, to the team, and to the role · Set the precedent. Orientation is necessary for new employees to learn company policies and procedures. It should be conducted in person, if possible, so they can ask questions. Orientation Best Practices · Prioritize creating connections, going over goals and values, and logistics · Schedule the most important activities early in the day. Learn how to implement a strategic onboarding process that engages and retains new employees. Discover best practices, tools, and tips for success. What Are Some Key Success Factors For An Effective Employee Onboarding Process? · Have a clear purpose · Minimize surprises · Be prepared · Exercise patience · Set a. The 16 Steps To Onboarding Best Practice · 1. Provision employees before they arrive · 2. Get paperwork out of the way · 3. Get the team involved (and aware) · 4. To start, encourage managers and team leaders to be as transparent as possible when it comes to training and onboarding goals. Keeping as much information as. What Are Employee Onboarding Best Practices? An onboarding program is more than just a new hire orientation. It's an opportunity to ensure strong employee. Employee orientation is the basic introduction of a new employee to their company, team, and role, and it can take anywhere from a day to a week. New employee. Onboarding is the orientation and integration of your new employee into your department. It provides your new employee with an overview of your department. In many businesses, onboarding is often confused with orientation – during which the employee might watch some videos, fill out paperwork and then be told to. My main recommendation is figuring out a reasonable timeline, allowing the new hire to actually have time to read, practice, question, document. It familiarizes them with company culture, policies, and expectations, helping them feel welcomed and valued. Onboarding vs. New Employee. It is important to develop good communication with the new employee from the start. Distinct, well-defined expectations will reduce potential misunderstandings. One of the employee experience best practices that companies often implement is engaging new recruits through company and department orientations. This stage. Maximizes productivity – Hiring new employees, training them, and waiting for them to figure things out is inefficient. It is in the organization's best. What Are Employee Onboarding Best Practices? An onboarding program is more than just a new hire orientation. It's an opportunity to ensure strong employee. Onboarding includes training and practical experiences that give employees deeper insights into the company and their job. Orientation, on the other hand, is. An orientation program is a great opportunity to communicate your company's mission, vision, and values and introduce new hires to the culture. Streamline Paperwork · Introduce New Hires to Your Team · Pair Employees With a Buddy · Spend More Time Onboarding · Drip Feed Employee Training · Leverage.

What Is The Best Investment For 1 Year

If you know you are going to need your money in three to five years, consider investing it in the stock market — but more conservatively. “You want to keep at. Once you complete 1 year of service, you own all contributions and earnings Fund Profiles, the Investment Fund Summary, and the Annual. Fee. Stocks don't guarantee returns like that over 2 years either, and can just as easily be a negative return over 2 years. Investment Portfolio, YTD Return1, 1 Year2, 3 Year2, 5 Year2, Since Inception2, Expense Ratio. Portfolio, %, %, N/A, N/A, %, %. 2. Cash management accounts · 3. Money market accounts · 4. Short-term corporate bond funds · 5. Short-term U.S. government bond funds · 6. Money market mutual. Best 1-year CD rates · Best 5-year CD rates. Get guidance. CD calculator · CD Your goal for the total value of your investment or investments. Years to. There are two kinds: EE bonds and I bonds. Both offer interest for the entire bond term, up to 30 years. You can buy savings bonds for as little as $25 and not. According to the Pew Research Center, even among families who earn less than $35, per year, one-in-five have assets in the stock market. Investing is less. 1. Liquid funds. These are one of the most popular methods of parking short term funds up to one year. These liquid funds typically invest in money market. If you know you are going to need your money in three to five years, consider investing it in the stock market — but more conservatively. “You want to keep at. Once you complete 1 year of service, you own all contributions and earnings Fund Profiles, the Investment Fund Summary, and the Annual. Fee. Stocks don't guarantee returns like that over 2 years either, and can just as easily be a negative return over 2 years. Investment Portfolio, YTD Return1, 1 Year2, 3 Year2, 5 Year2, Since Inception2, Expense Ratio. Portfolio, %, %, N/A, N/A, %, %. 2. Cash management accounts · 3. Money market accounts · 4. Short-term corporate bond funds · 5. Short-term U.S. government bond funds · 6. Money market mutual. Best 1-year CD rates · Best 5-year CD rates. Get guidance. CD calculator · CD Your goal for the total value of your investment or investments. Years to. There are two kinds: EE bonds and I bonds. Both offer interest for the entire bond term, up to 30 years. You can buy savings bonds for as little as $25 and not. According to the Pew Research Center, even among families who earn less than $35, per year, one-in-five have assets in the stock market. Investing is less. 1. Liquid funds. These are one of the most popular methods of parking short term funds up to one year. These liquid funds typically invest in money market.

If you saved that $ for just one year, and put it into a savings account The best investment professional is one who fully understands your. one year and other conservative investments. Morningstar ratings - System Top five contributors - Top five industries in a portfolio based on amount of. Best Mutual Funds for Lumpsum Investment ; Axis Small Cap Fund. Equity. % ; Aditya Birla Sun Life Medium Term. Debt. %. ; Nippon India Nivesh Lakshya Fund. 1. Fixed Deposits · 2. Savings Accounts · 3. Recurring Deposits · 4. Money Market Funds · 5. Treasury Bills. Best Short-Term Investment Options for 3 Months · Recurring Deposits · Bank Fixed Deposits · Treasury Securities · Money Market Account · Stock Market /Derivatives. Top Investment Plans · Bank Fixed Deposit (FD): · Recurring Deposit: · Post Office Term Deposit: · Fixed Maturity Plans: · Arbitrage Mutual Funds: · Debt. Understand what types of investments may best align with your investment objectives. Stocks may outpace in one year, but then reverse in the next year. Or. best interests of the Fund. An investment in the Schwab Money Funds is *The annual percentage yield (APY) displayed includes 3-month to 1-year values. One such fund is the Vanguard Short-Term Tax-Exempt Fund Investor Shares (VWSTX). The fund invests in high-quality, short-term municipal securities with an. Unlock investing basics. Learning about financial topics is a great way to gain confidence as you start your investing journey. There are many ways to build wealth, and passive income is a simple one. Learn all about passive income and how you can start building wealth today. Publicly. CDs are low-risk, FDIC-insured investments that offer fixed interest rates over a set period (often six months to five years). Their returns are usually higher. Choose a Target Year Portfolio or DIY. We've Got Options. Choose the investment option that best meets your goals. This investment option is backed by the US government and comes in 3 types: bills, notes, and bonds. Bills mature in one year or less, notes span up to 10 years. One of the safest and easiest short-term investment options is a high-yield savings account. They work the same as a standard savings account. You deposit money. The interest rate on a particular I bond changes every 6 months, based on inflation. Can cash in after 1 year. (But if you cash before 5 years, you lose 3. One such fund is the Vanguard Short-Term Tax-Exempt Fund Investor Shares (VWSTX). The fund invests in high-quality, short-term municipal securities with an. It's a measure of the income an investment pays during a specific period, typically a year, divided by the investment's price. AR = (1 + return)(1 / years) -. A $1 million investment in a money market account could earn you $5, per year in interest income. Another great option you can explore is the Lyons Enhanced. You're looking for an investment customized for your student's expected enrollment year. Can be a good, all-in-one solution to manage your savings over the.