astro-athena.ru News

News

Factoring Invoices Cost

Depending on the factor and the factoring period, it could range from two to 10 percent of the invoice. If you're also dealing with a large amount of invoices. When it comes to us, our factoring fees tend to hover around % and % each of the days an invoice is outstanding, or once it's factored. For 30 days, this. It typically ranges between $5 and $30, but altLINE does not charge for ACH transfers. ACH fees should be negotiated out of factoring contracts. However, you can expect a total invoice factoring fee of 1% to 3% for the first month and an additional % to 1% every ten days thereof. Most factors use one. Most factoring companies make extra charges such as arrangement fees (to set up the facility), exit or termination fees, survey fees, audit fees and penalty. The service fee is usually charged as a percentage of your invoices/turnover. This would commonly range from – 3% and is often subject to a minimum monthly. Generally, you can expect to pay from 1 to 4% of the invoice amount factored as invoice factoring fees. Invoice factoring providers typically charge between 1% and 5% of the invoice value in factoring fees. The percentage depends on conditions like invoice amount. Factoring rates range from % to % per 30 days. Advances range from 70% to 85%. There are some exceptions, such as transportation and staffing. Depending on the factor and the factoring period, it could range from two to 10 percent of the invoice. If you're also dealing with a large amount of invoices. When it comes to us, our factoring fees tend to hover around % and % each of the days an invoice is outstanding, or once it's factored. For 30 days, this. It typically ranges between $5 and $30, but altLINE does not charge for ACH transfers. ACH fees should be negotiated out of factoring contracts. However, you can expect a total invoice factoring fee of 1% to 3% for the first month and an additional % to 1% every ten days thereof. Most factors use one. Most factoring companies make extra charges such as arrangement fees (to set up the facility), exit or termination fees, survey fees, audit fees and penalty. The service fee is usually charged as a percentage of your invoices/turnover. This would commonly range from – 3% and is often subject to a minimum monthly. Generally, you can expect to pay from 1 to 4% of the invoice amount factored as invoice factoring fees. Invoice factoring providers typically charge between 1% and 5% of the invoice value in factoring fees. The percentage depends on conditions like invoice amount. Factoring rates range from % to % per 30 days. Advances range from 70% to 85%. There are some exceptions, such as transportation and staffing.

The structures are called fixed-rate pricing, variable-rate pricing, and discount-plus-margin pricing. In this section we describe how each pricing structure. Most of the cost of invoice factoring comes from the factoring fee, which is usually between one and five percent of the invoice's value. Again. Some lenders have an all inclusive service fee while others will charge in addition to the service fee for various services. You will see that the discounting. This fee is typically a percentage of the credit line from the factoring company. The rate paid varies based on the factoring company you use and the terms. Universal Funding's factoring rates start as low as % and are usually no higher than 2%. There are many factors to consider when calculating the cost of. At Business Finance Corporation, an invoice that is not paid within 30 days will accrue daily fees at 1/30th of the factoring rate per day. For instance, if. When it comes to us, our factoring fees tend to hover around % and % each of the days an invoice is outstanding, or once it's factored. For 30 days, this. Triumph's fee takes into account the credit risk associated with your customers and the time it takes them to pay their invoices. In fact, invoice factoring. The factoring rate is the fee a business pays for the factoring service – and how the factoring company makes money. You'll sometimes see the factoring rate. A factoring company may charge 2 per cent for the first 30 days and per cent for every 10 days the invoice remains unpaid. A factoring company may charge 2% for the first 30 days and % for every 10 days that the invoice remains unpaid. Fees are often referred to as invoice. Or factoring fee ranges between 2% - % for the 30 days. We DO NOT charge and APR on top of the factoring fee (most of our competitors do). For a reputable company with consistent, recurring revenue from a reputable customer base, a good invoice factoring rate may be somewhere in the ballpark of The invoice factoring rate is the discount rate used to calculate factoring fees. The advance rate is usually between % to 5%. Every borrower's rate is. Invoice factoring is best for small businesses that need working capital and have reliable customers. Factoring invoices costs run high, but it's worth it if. The average invoice factoring rates tend to be around % of the value of the invoice with all fees considered, but the way lenders arrive at the cost can. Once the factor collects from the end customer on the standard payment terms, they release the remainder of the invoice value to you, minus a small factoring. Interest: Factoring companies' interest rates typically range from to 4 percent per month, much higher than conventional financing. Late payment fee. Add-on fees, intro rates, auto-renewal clauses and other hidden costs of invoice factoring drive up costs and detract from the benefits of factoring AR. The short answer is – that it depends. There isn't a one-size-fits-all cost structure for invoice factoring.

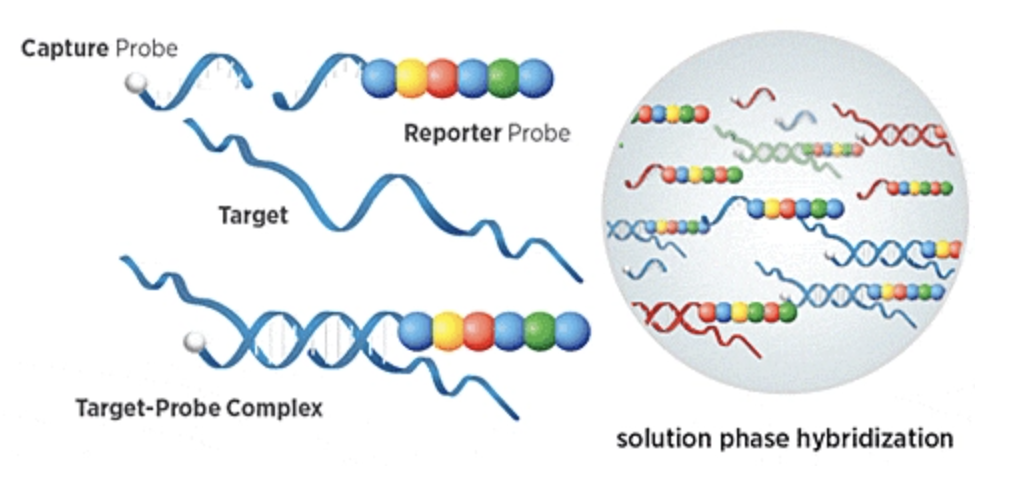

Nanostring Price

NanoString Tech (NSTG) PT Lowered to $ at UBSUBS analyst John Sourbeer lowered the price target on NanoString Tech (NASDAQ: NSTG) to $ (from $). Codeset cost depends on the number of interrogated genes and samples to be analyzed. The larger is the codeset, the most attractive is the cost per sample. How to buy NanoString Technologies Stock? As of the end of day on the Sep 04, , the price of an NanoString Technologies (NSTG) share was $ NanoString Technologies, Inc. (NSTG) - Price History ; July , $, $ ; June , $, $ ; May , $, $ ; April , $, $ NanoString Technologies Inc () is listed in the sector of the OTCMarkets with ticker NSTGQ. The last closing price for NanoString Technologies () was $ The nCounter platform provides a simple and cost-effective solution for multiplex analysis of up to RNA, DNA, or protein targets. NanoString Pricing Sample hybridization from submitted input sample (extracted RNA or cell lysate) is $ per cartridge (12 samples). This step can be. NanoString's. Human, Mouse or Rat miRNA catalog probes. MasterKits prices are included. Base price includes 20 miRNAs. Custom CodeSet measuring miRNAs and. RNA Whole Transcriptome Package (mouse or human): $2, per slide for reagents + $ for labor per slide + $ machine per slide for machine use (UCSD. NanoString Tech (NSTG) PT Lowered to $ at UBSUBS analyst John Sourbeer lowered the price target on NanoString Tech (NASDAQ: NSTG) to $ (from $). Codeset cost depends on the number of interrogated genes and samples to be analyzed. The larger is the codeset, the most attractive is the cost per sample. How to buy NanoString Technologies Stock? As of the end of day on the Sep 04, , the price of an NanoString Technologies (NSTG) share was $ NanoString Technologies, Inc. (NSTG) - Price History ; July , $, $ ; June , $, $ ; May , $, $ ; April , $, $ NanoString Technologies Inc () is listed in the sector of the OTCMarkets with ticker NSTGQ. The last closing price for NanoString Technologies () was $ The nCounter platform provides a simple and cost-effective solution for multiplex analysis of up to RNA, DNA, or protein targets. NanoString Pricing Sample hybridization from submitted input sample (extracted RNA or cell lysate) is $ per cartridge (12 samples). This step can be. NanoString's. Human, Mouse or Rat miRNA catalog probes. MasterKits prices are included. Base price includes 20 miRNAs. Custom CodeSet measuring miRNAs and. RNA Whole Transcriptome Package (mouse or human): $2, per slide for reagents + $ for labor per slide + $ machine per slide for machine use (UCSD.

The NanoString nCounter is a single-molecule counting device for the 12 - 48 samples, 12 - 24 samples. Notes Price: Excludes CodeSet cost, but. NanoString nCounter Service Fees ; Expression Profiling Panels. Standard: $ Low Input: $59 ; MicroRNA Panels, $44 ; miRGE, $44 ; Other Applications, Contact. NanoString Phenotyping, $ Molecular Karyotyping Standard Genomics core qPCR instrument price per well plate ($40 per plate [8 samples per. Get the most out of every experiment with our cost effective predefined high-plex panels with the option to customize. FFPE Compatibility. Get single-cell. Real time NanoString Technologies (NSTG) stock price quote, stock graph, news & analysis. Basic Stats. The share price of NanoString Technologies, Inc. as of February 13, is $ / share. The Factor Analysis chart . Shop NanoString Technologies for New, Used and Refurbished Price: High to Low, Price: Low to High. 25/Page, 50/Page, 75/Page, /Page. NanoString. Services, Unit, NU/CBC, External, Industrial. NanoString SPRINT Run, Cartridge, $, $, $ Nanostring Sample Hybridization, Cartridge, $ Your source for NanoString product manuals, videos, tips and more. Support & Resources; Product Support More. Product Support. NanoString Technologies stock price, live market quote, shares value, historical data, intraday chart, earnings per share and news. NanoString has granted to the underwriters of the offering a day option to purchase up to an additional , shares of common stock at the public offering. NanoString Technologies Announces Pricing of Offering of 3,, Shares of Common Stock. SEATTLE, June 01, (GLOBE NEWSWIRE) -- NanoString Technologies. Stock price history for NanoString Technologies (NSTG). Highest end of day price: $ USD on Lowest end of day price: $ USD on. Single-Cell Sequencing Library Prep · Spatial Transcriptomics · Sample Prep and QC · DNA Extraction · Cell Line Authentication · Array Processing · NanoString. NanoString Pricing. NanoString Pricing. Name of service, description, price (Note: Non-UK clients pay list price plus 10%). RES MI-RNA PROCESSING, miRNA. UAB Nanostring Laboratory Schedule of Fees and Services effective 01/01/ Per sample cost: Nanostring Laboratory Services. FBS SKU. FBS Dis 2. Genomics Home Page Genomics Rates Request Service. NanoString - nCounter Sprint Profiler DNA, RNA and Protein Analysis. Molecular barcoding technology for RNA. Historical price to book ratio values for NanoString Technologies, Inc. (NSTGQ) over the last 10 years. The current price to book ratio for NanoString. EquipNet Listing #, Price: € EUR. NanoString is a fully automated BioXpedia A/S is a contract research laboratory founded in by CEO Mogens Kruhøffer to provide high quality cost.

Best Diy Stock Trading Platform

With a broad range of platforms, tools and educational resources for every type of investor, we make online investing and trading easy, accessible and. Stocks · Equity investors can access publicly traded stocks from diverse market sectors. · Real-time quotes are available. · The trading platform is a basic web-. Robinhood is the best/cheapest brokerage now by a significant margin. They used to suck, but they've had a few years to fix all their problems. What is the best Canadian trading platform for beginners? Questrade is a good choice for beginners as you have the option to use their Questwealth Portfolios. We're constantly working to give you the best price on trades with a low effective over quoted spread (E/Q). See how brokerage is built for you · Understand. With a broad range of platforms, tools and educational resources for every type of investor, we make online investing and trading easy, accessible and. What makes it great: SoFi Invest is an excellent online brokerage account option for newly active stock traders. Any digital native, from Gen X to Gen Z, will. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. After hundreds of hours of comprehensive research, data analysis, and live broker platform demos, Fidelity Investments is our best overall online brokerage. With a broad range of platforms, tools and educational resources for every type of investor, we make online investing and trading easy, accessible and. Stocks · Equity investors can access publicly traded stocks from diverse market sectors. · Real-time quotes are available. · The trading platform is a basic web-. Robinhood is the best/cheapest brokerage now by a significant margin. They used to suck, but they've had a few years to fix all their problems. What is the best Canadian trading platform for beginners? Questrade is a good choice for beginners as you have the option to use their Questwealth Portfolios. We're constantly working to give you the best price on trades with a low effective over quoted spread (E/Q). See how brokerage is built for you · Understand. With a broad range of platforms, tools and educational resources for every type of investor, we make online investing and trading easy, accessible and. What makes it great: SoFi Invest is an excellent online brokerage account option for newly active stock traders. Any digital native, from Gen X to Gen Z, will. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. After hundreds of hours of comprehensive research, data analysis, and live broker platform demos, Fidelity Investments is our best overall online brokerage.

Stake: Best Platform for Extended Hours, Education, and Trading of Unsettled Funds · Stake in a nutshell: Stake offers dynamic access to over 6, US stocks. Stock Markets - Virtual Stock Trading with Real Life World Stock Market Data. Trading simulator for BSE, NSE, NASDAQ, DOW, S&P Includes stocks from India. For new investors Trading are giving away a free stock worth up to £ when you sign up via Money Unshackled. Key Info. Platform Charge: FREE. Funds: Not. Of the online share trading platforms in this year's award ratings, Tiger Brokers is the only one to earn a top 5-Star rating for Overall Satisfaction from its. If you want to get into day trading, IBKR, Schwab (thinkorswim), or tastytrade are your best bet. Not even sure if Vanguard's boomer interface. Real estate is my favorite way to build wealth because it is a tangible asset that is less volatile, provides utility, and generates income. Stocks are fine. Best for: DIY types with time to spare. Low. Webull offers fractional shares trading, so investors can get started buying certain stocks and ETFs for as little as $5. If you're totally new to investing. Get started with advanced charting, market analysis, and trade simulation for free. NinjaTrader offers advanced charting, including the ability for you to trade. Looking to trade stocks online? Fidelity offers unlimited trades and low commissions with its stock trading account. Learn more here. Specifically, their trading platforms Questrade Edge Web and Questrade Edge Desktop provide information on trending stocks, analyst ratings and Smart scores. RBC Direct Investing Online · Build Your Portfolio with the Tools You Need · Validate Ideas with Top-Tier Research · Practice Trading Stocks and More. Every eToro account is also credited with $, (£78,) in a virtual portfolio so investors can practice trading on markets in real time. This makes it a. Looking to trade stocks online? Fidelity offers unlimited trades and low commissions with its stock trading account. Learn more here. WellsTrade is the best way for do-it-yourself investors to trade stocks, ETFs, mutual funds, bonds, and more—all with $0 commission trades and no annual. Invest your way, commission-free Build your own portfolio with thousands of stocks, ETFs, and options — all on our powerful, yet easy-to-use trading platform. We recommend Ally Invest for our clients because of its low cost, great options trading platform, and excellent customer service. eToro is a trading platform that offers investing in stocks and cryptoassets, as well as trading CFDs. With eToro, beginners and expert traders in the UK have. WellsTrade® gives you the flexibility to trade stocks on your own with enhanced market research and extended trading hours. Get started with advanced charting, market analysis, and trade simulation for free. NinjaTrader offers advanced charting, including the ability for you to trade.

Major Us Cities

1. New York, NY NYC has topped America's Best Cities since our inaugural ranking. In , it is US urban recovery writ large, with a dizzying roster of new. Browse 1,,+ us cities stock photos and images available, or search for major us cities or us cities stamp to find more great stock photos and pictures. 10 Largest Cities in the U.S. · 1. New York · 2. Los Angeles · 3. Chicago · 4. Houston · 5. Phoenix · 6. Philadelphia · 7. San Antonio · 8. San Diego. Rankings of the largest American cities using frequently requested population, demographic, and social indicators from the United States Census Bureau. Redlining in New Deal America In the s the federal government created redlining maps for almost every major American city. Mapping Inequality lets you. Discover the most polluted cities in the United States and learn more about how your city ranks. Some metropolitan areas include more than one large historic core city; examples include the Dallas–Fort Worth metroplex, Virginia Beach–Norfolk–Newport News . Elevations of the 50 Largest Cities (by population, Census) ; New York, New York, 1 ; Chicago, Illinois, 2 ; Los Angeles, California, 3 ; Philadelphia. Twenty-Five Largest U.S. Cities by Population: General and Economic Information. Resident Population1. Number of Daytime. Commuters2. % Change Due to Commuters. 1. New York, NY NYC has topped America's Best Cities since our inaugural ranking. In , it is US urban recovery writ large, with a dizzying roster of new. Browse 1,,+ us cities stock photos and images available, or search for major us cities or us cities stamp to find more great stock photos and pictures. 10 Largest Cities in the U.S. · 1. New York · 2. Los Angeles · 3. Chicago · 4. Houston · 5. Phoenix · 6. Philadelphia · 7. San Antonio · 8. San Diego. Rankings of the largest American cities using frequently requested population, demographic, and social indicators from the United States Census Bureau. Redlining in New Deal America In the s the federal government created redlining maps for almost every major American city. Mapping Inequality lets you. Discover the most polluted cities in the United States and learn more about how your city ranks. Some metropolitan areas include more than one large historic core city; examples include the Dallas–Fort Worth metroplex, Virginia Beach–Norfolk–Newport News . Elevations of the 50 Largest Cities (by population, Census) ; New York, New York, 1 ; Chicago, Illinois, 2 ; Los Angeles, California, 3 ; Philadelphia. Twenty-Five Largest U.S. Cities by Population: General and Economic Information. Resident Population1. Number of Daytime. Commuters2. % Change Due to Commuters.

Major Cities ; 1, New York, NY ; 2, Los Angeles, CA ; 3, Chicago, IL ; 4, Houston, TX. US Cities: Demographics ; 1. Newark. New Jersey ; 2. Peoria. Illinois ; 3. O'Fallon. Missouri ; 4. Hampton. Virginia. Earshot Jazz Festival in October and November is the biggest jazz festival in the city, but you can also plan a trip around the Bellevue Jazz & Blues Music. Largest cities in the world. Cities 1 to IN THIS SECTION: Largest cities: Introduction & research methodology ||| Largest cities 1 to ||| Largest. The 50 largest cities in the United States · 1 New York 8,, · 2 Los Angeles 3,, · 3 Chicago 2,, · 4 Houston 2,, · 5 Philadelphia. U.S. States, Capitals, and Largest Cities ; Alabama, Montgomery, Birmingham ; Alaska, Juneau, Anchorage ; Arizona, Phoenix, Phoenix ; Arkansas, Little Rock, Little. Largest Cities in the U.S. () ; 1, New York, New York, 8,, ; 2, Los Angeles, California, 3,, ; 3, Chicago, Illinois, 2,, ; 4, Houston, Texas. The largest city in United States is New York City, with a population of 8,, people. Geonames. Sources. List of US Cities and Towns - A ; Addison, Texas ; Adelanto, California ; Adelphi, Maryland ; Adrian, Michigan ; Affton, Missouri. New York City,LA, Chicago, Houston, Phoenix, Philadelphia,San Antonio,San Diego,Dallas,Austin. Archived post. New comments cannot be. The largest US cities: Cities ranked 1 to ; 3. Chicago; Illinois. 2,, ; 4. Houston; Texas. 2,, ; 5. Philadelphia; Pennsylvania. 1,, ; 6. Free and commercial U.S. cities Also, the Census Bureau will only provide demographic data if the city/town is large enough to protect resident privacy. Current time now in several USA cities, representing each of the major American time zones. Current time now in several USA cities, representing each of the major American time zones. US Census. State. City. Population. Irvine. , San Bernardino. , Modesto. , Oxnard. , Fontana. , Moreno Valley. The U.S.: Cities - Map Quiz Game. Albuquerque; Atlanta; Austin; Baltimore; Birmingham; Boise; Boston; Buffalo; Charlotte. for example) should not pose a problem, but they're not all so simple. Test yourself on US cities large and small, with the help of this map quiz! More than urban areas in the U.S. have populations above ,; New York City, with million inhabitants, is the largest.3,4; While the rate of. The largest city in Oklahoma offers remarkably affordable prices for its size. The biggest reason: Housing costs run 37% below the national average, according.

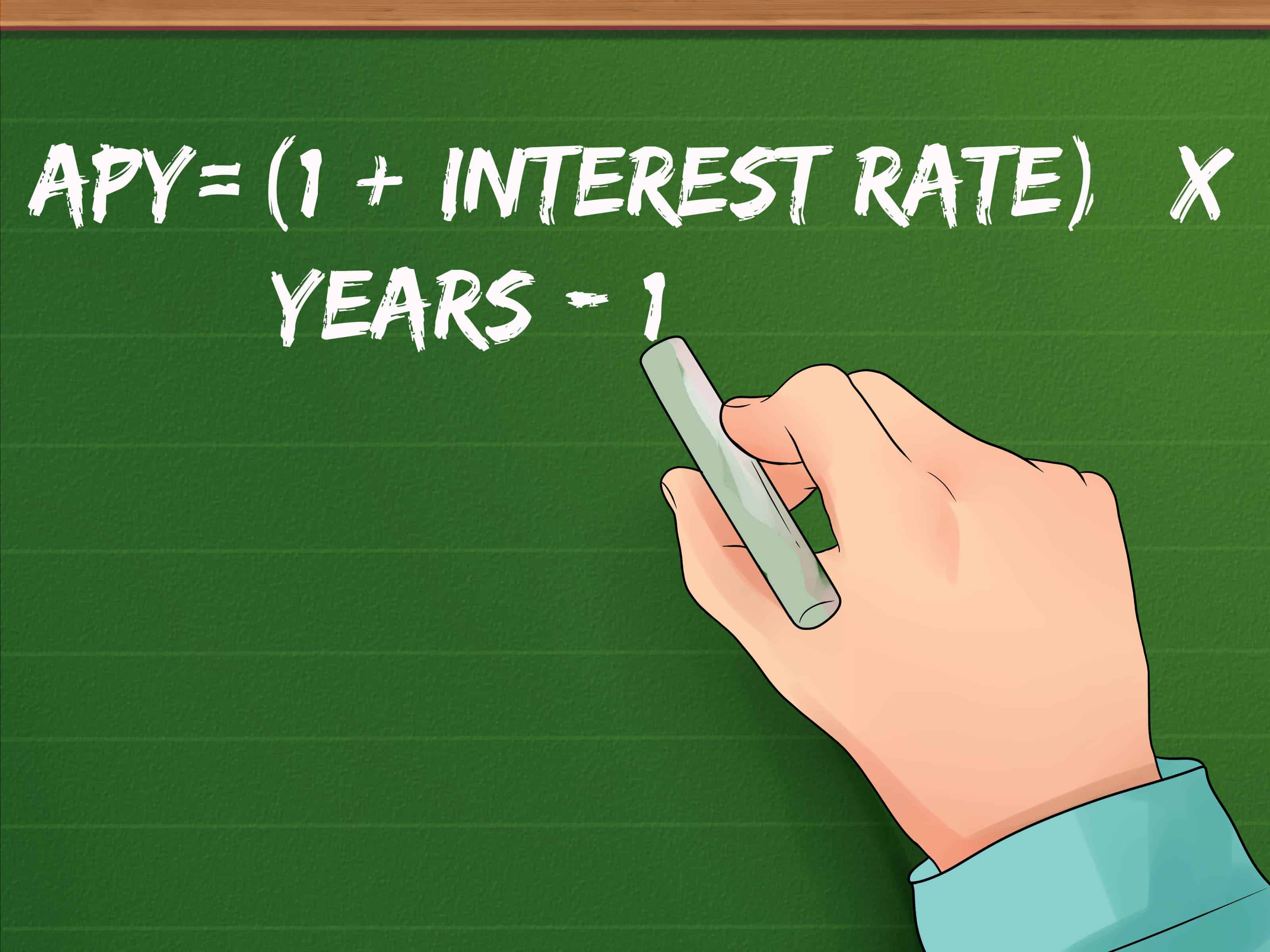

What Is A Apy

APY? APR is applied to loans, credit cards, and mortgages to show the expense of borrowing money. It encompasses both interest rates and fees. APY is for. What Is APY In Business Banking & How To Calculate It · APY tells you how much interest you will earn on a deposit account in a year. · Interest rate is the. Annual Percentage Yield (APY) is the total earnings accumulated in one year after opening a bank account. Learn why APY matters and how to calculate apy. Imagine you put $10, in an account that earns 5% APY, compounded annually. In the first year, you'd earn $ (5% of $10,). Now, your total is $10, In. A savings vehicle or loan might have an APR of 5% but an APY of % if the interest is compounded quarterly, or an APY of % if the compounding is done. APY” is used for convenience in the formulas). APY = [(1 + Interest/Principal)(/Days in term)−1]. “Principal” is the amount of funds assumed to have. APY, or annual percentage yield, is the real rate of return on money in a bank account and includes how often interest compounds1 or gets added to your balance. APY reflects the interest rate and the frequency of compounding interest for a one-year period. If you want to learn more about how compounding interest works. With an initial deposit of $3, you can multiply that amount by the APY ($3, x %) and see how much your money would grow to within the year. Given. APY? APR is applied to loans, credit cards, and mortgages to show the expense of borrowing money. It encompasses both interest rates and fees. APY is for. What Is APY In Business Banking & How To Calculate It · APY tells you how much interest you will earn on a deposit account in a year. · Interest rate is the. Annual Percentage Yield (APY) is the total earnings accumulated in one year after opening a bank account. Learn why APY matters and how to calculate apy. Imagine you put $10, in an account that earns 5% APY, compounded annually. In the first year, you'd earn $ (5% of $10,). Now, your total is $10, In. A savings vehicle or loan might have an APR of 5% but an APY of % if the interest is compounded quarterly, or an APY of % if the compounding is done. APY” is used for convenience in the formulas). APY = [(1 + Interest/Principal)(/Days in term)−1]. “Principal” is the amount of funds assumed to have. APY, or annual percentage yield, is the real rate of return on money in a bank account and includes how often interest compounds1 or gets added to your balance. APY reflects the interest rate and the frequency of compounding interest for a one-year period. If you want to learn more about how compounding interest works. With an initial deposit of $3, you can multiply that amount by the APY ($3, x %) and see how much your money would grow to within the year. Given.

Annual percentage yield (APY) is a normalized representation of an interest rate, based on a compounding period of one year. APY figures allow a reasonable. What is APY on a savings account? Simply stated, it's the actual amount you'll earn with the addition of compound interest. Learn more at Citizens. Desktop. In Exodus Desktop, a) click on the Portfolio tab. b) Click APY Rewards to filter by staking assets. The APY Rewards column displays the current APY for. Annual percentage yield (APY) and annual percentage rate (APR) are the terms used to indicate the interest earned or paid on a particular amount. APR is the. APY stands for Annual Percentage Yield, the percentage return on your money. It's an excellent way to compare different banks' accounts because it accounts. When shopping for a CD or savings account, the best way to compare options is by looking at APY. APY considers both the interest rate and frequency of the. What is the difference between the interest rate & the Annual Percentage Yield (APY) on my CD? The interest rate is used to determine how much interest the CD. Which Is Better, APR or APY? Both are helpful when you're shopping for rates and comparing which is best for you. APY helps you see how much you could earn over. APR vs APY vs. Interest Rate: What's the difference? · APR represents the total yearly cost of borrowing money, expressed as a percentage, and includes the. While you may see the terms interest and APY used interchangeably, they are not identical. APY expresses how much you will earn on your cash over the course of. What's the difference between APY and interest rate? APY is the total interest you earn on money in an account over one year, whereas interest rate is simply. Remarkable Checking annual percentage yield (APY): % APY applies to the first $20, and % - % APY on balances greater than $20, if all. APY reflects the actual rate of return on your savings and investments, depending on how frequently interest is calculated - daily, monthly, or quarterly. For. How do I calculate my APY? If you're looking to understand the math behind calculating your APY, there's a formula: APY = [(1 + Interest/Principal)(/Days. How to Calculate By APY Formula: · 1. First, we need to determine the number of compounding periods in a year. · 2. Next, we divide the annual interest rate by. APY=Annual Percentage Yield. Otherwise, Alliant checking accounts do not earn a dividend. The 8/9/ High Rate Checking dividend provides an Annual. In traditional finance, APY is used for things like savings accounts and certificates of deposit. In crypto, there are many ways to earn interest on your. APY stands for Annual Percentage Yield. It is basically a fancy name for the rate of return you get on your money after accounting for compounded interest. In a. You can calculate the APY on an account by using the following formula: APY = (1 + r/n)ⁿ – 1, where r= interest rate and n= the number of times the interest is. Each day you'll have more money in your account, and it'll compound exponentially. A theoretical % APY translates to a % interest rate, and the interest.

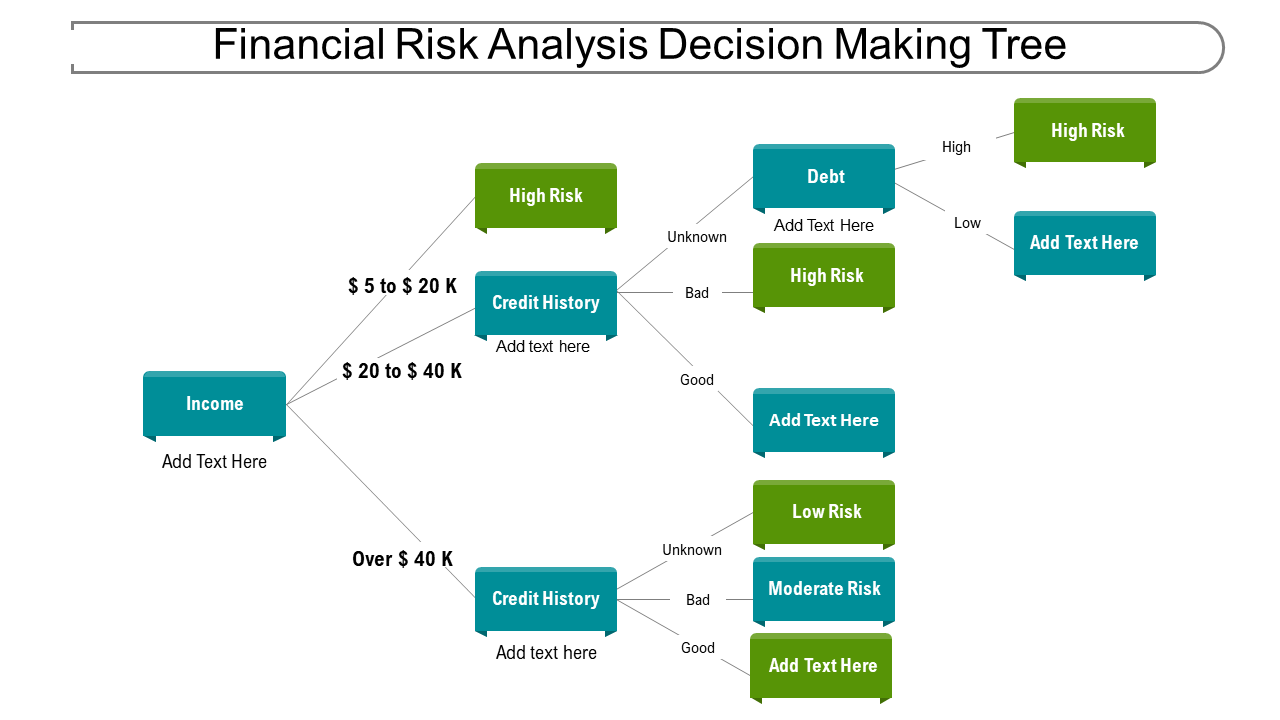

Decision Tree Finance

Table 8 includes estimates of the financial impact. So, for example, in the first row, it has been estimated that in council A, if party J were business. A decision tree is a tool used to formalize the brainstorming process in decision-making. It is a flow chart that creates a graphical representation of possible. A decision tree is a support tool with a tree-like structure that models probable outcomes, cost of resources, utilities, and possible consequences. FASB Accounting Standards Codification: Copyright © - by Financial Accounting Foundation, Norwalk, Connecticut. Deloitte Accounting Research Tool. Decision trees are a major tool in corporate finance. Discover how binomial trees play an integral role in the pricing of interest rates. A decision tree is a diagrammatic representation of a problem and on it we show all possible courses of action that we can take in a particular situation. Risk Management: Decision trees assist in efficiently quantifying and evaluating potential risks, enabling firms to navigate through uncertain. The value of a decision tree in making financial decisions is the easy visual comparison of relative risks versus rewards, particularly if you are using the. Decision Trees clarify the connection between current and future decisions and uncertain circumstances and help us to evaluate investment opportunities. Table 8 includes estimates of the financial impact. So, for example, in the first row, it has been estimated that in council A, if party J were business. A decision tree is a tool used to formalize the brainstorming process in decision-making. It is a flow chart that creates a graphical representation of possible. A decision tree is a support tool with a tree-like structure that models probable outcomes, cost of resources, utilities, and possible consequences. FASB Accounting Standards Codification: Copyright © - by Financial Accounting Foundation, Norwalk, Connecticut. Deloitte Accounting Research Tool. Decision trees are a major tool in corporate finance. Discover how binomial trees play an integral role in the pricing of interest rates. A decision tree is a diagrammatic representation of a problem and on it we show all possible courses of action that we can take in a particular situation. Risk Management: Decision trees assist in efficiently quantifying and evaluating potential risks, enabling firms to navigate through uncertain. The value of a decision tree in making financial decisions is the easy visual comparison of relative risks versus rewards, particularly if you are using the. Decision Trees clarify the connection between current and future decisions and uncertain circumstances and help us to evaluate investment opportunities.

Decision Trees in corporate finance serve as a crucial tool for mapping potential outcomes of decisions, evaluating risks, and forecasting returns. A decision tree is a tree-like model that acts as a decision support tool, visually displaying decisions and their potential outcomes, consequences, and costs. Home | BPS – decision tree. BPS – decision tree. ← Previous: BPS – decision tree · FINANCE DIVISION. University of Toronto Toronto, ON M5S 1A2 Phone: Decision trees make state-contingent future decisions but with a constant discount rate, Source: FET, Corporate Finance Theory, Chapter 9, pages Decision Tree Investment Advisors LLC is a Registered Investment Advisory Firm and complies with all applicable laws and regulations. Kevin Wenke is also an. A decision tree does not give management the answer to an investment problem; rather, it helps management determine which alternative at any particular choice. A step by step decision tree helps you examine your income (money coming in) and expenses (money going out) and put a plan in place to balance them. Financial inclusion can be a catalyst for economic development and a source of economic empowerment, especially through digital means, which lower costs and. Decision tree analysis is the process of graphically charting out business decisions. In a nutshell, you list out every decision and every possible consequence. Decision tree analysis involves making a tree-shaped diagram to chart out a course of action or a statistical probability analysis. Decision Tree Basics. Each branch of a decision tree reflects a distinct result based on the provided probabilities. Decision trees are useful for organizing choices in a hierarchical structure that let you analyze and examine consequences. The financial risk early warning management system based on decision tree algorithm can effectively and accurately prevent the financial management risks of. This climate finance decision-making tree guides local and regional governments through a series of questions that help them consider different financing. At Decision Tree Financial, we believe we stand apart from the crowd because of our unwavering commitment to client-centric service and innovative solutions. ESPC Financing Decision Tree. This flowchart walks users through questions corresponding to the considerations that go into deciding on the financing options. Decision trees are useful tools, particularly for situations where financial data and probability of outcomes are relatively reliable. They are used to. Decision Trees are powerful Machine Learning algorithms that are used for classification. It's a flowchart-like structure where every node represents a “test”. A Decision Tree in the context of corporate finance is a visual representation, or a model structure, that assists in the decision-making process. With its tree. Fixed costs between $40 (wc) and 20 million (bc). From Principles of Corporate Finance, (c) Brealey/Myers. Jalopy Example (cont.) Explanations. NPV is.

Rounding Up Savings App

The round-ups from your debit card purchases are accumulated and transferred daily from your checking account to your savings account. This calculator is for. Reach important savings goals, faster · Save money without even thinking about it · Get a 5% match of your rounded-up savings every month. We'll automatically round up your purchases to the next dollar, and invest your change once it adds up to $5. Round-Ups® tap into the power of dollar-cost. Automatically round up purchases to the nearest dollar amount and transfer the change into your savings account, with every debit card transaction. Round Up Savings is an automated and simple way to grow your savings every time you make a debit card purchase. Every time you buy something with your Everwise Credit Union Debit Mastercard®, we'll round up the purchase amount to the nearest dollar. Round Up to Savings works like an automatic savings account. Your everyday debit card transactions are rounded-up to the next dollar amount. Round-ups are an easy way to save every time you use your One debit card. When turned on, every card transaction you make is rounded up to the next whole dollar. Wells Fargo has this. It's called Way2Save and it puts one dollar in your savings account for every operation over your checking account. The round-ups from your debit card purchases are accumulated and transferred daily from your checking account to your savings account. This calculator is for. Reach important savings goals, faster · Save money without even thinking about it · Get a 5% match of your rounded-up savings every month. We'll automatically round up your purchases to the next dollar, and invest your change once it adds up to $5. Round-Ups® tap into the power of dollar-cost. Automatically round up purchases to the nearest dollar amount and transfer the change into your savings account, with every debit card transaction. Round Up Savings is an automated and simple way to grow your savings every time you make a debit card purchase. Every time you buy something with your Everwise Credit Union Debit Mastercard®, we'll round up the purchase amount to the nearest dollar. Round Up to Savings works like an automatic savings account. Your everyday debit card transactions are rounded-up to the next dollar amount. Round-ups are an easy way to save every time you use your One debit card. When turned on, every card transaction you make is rounded up to the next whole dollar. Wells Fargo has this. It's called Way2Save and it puts one dollar in your savings account for every operation over your checking account.

Get into a good savings habit without even trying. Round Ups take your purchases and kicks them up to the nearest dollar, putting those extra cents into the. We'll round up the total purchase to the nearest whole dollar and automatically deposit the difference into your designated checking or savings account. A hybrid savings and investing and savings app that rounds up every purchase to the nearest dollar and invests the difference. Unlike the other apps listed here. Open extra accounts in the app so you can spend, budget and set aside money easily. In-app card control. You decide how and where your. We'll round up your purchase to the nearest dollar amount and transfer the change from your checking account to your savings account — or to a child's savings. With Round Up to Save®, every purchase with your debit card, we round up to the next dollar and transfer the difference to your savings account. Round Up your savings with Centier's Round Up Savings Special. Earn up an additional % when you sign up + receive a 50% match on Round Up transfers in. Smart Round-Ups · How it works? · Save spare change every day · Set your goals and set aside small amounts · Access your savings from the Bright app · Know more. Round Up your savings with Centier's Round Up Savings Special. Earn up an additional % when you sign up + receive a 50% match on Round Up transfers in. Donors using RoundUp App can discover nonprofits, find new causes to support, and manage all of their charitable giving from our donor app. With options for. Just like you might toss coins into a money jar, our round up feature automatically rounds up your transactions to the nearest $1, $2 or $5 (it's up to you). Savings apps that automatically round your purchases to the nearest dollar are bringing back the simplicity that spare change brought to saving. After you enable Round Ups, we will automatically round up to the nearest dollar and save or invest spare change from your Cash balance each time you use your. One of the first services to offer a round-up option in the UK, MoneyBox is different from the others as it's not a bank. Once it's rounded up the money you've. By connecting a bank account or credit card to the Moneybox app, you can view your everyday transactions and choose to 'round up' the digital spare change. Use the app to switch between single and double Round Ups, or turn Round Ups off and on, whenever you want. · Round Ups will never take you into overdraft - we'. Automatically round up purchases to the nearest dollar amount and transfer the change into your savings account, with every debit card transaction. Round Up is a simple way to grow your savings every time you make a debit card purchase. Round Up helps you save by rounding up your debit card purchase. 2. Stash Once upon a time, Stash was an app that was mostly focused on investing any amount of money you want. In other words, no minimum needed to invest. A Step Ahead for Your Savings · When you open a Debit Card Round Up Account you can: · Have every debit card transaction rounded up to the nearest whole dollar.

Buying A Home In Switzerland

Looking to buy a house or a chalet in Switzerland? Using the largest real estate search at astro-athena.ru you can quickly find just the right house. A financial check is the basis for purchasing your own home in Switzerland. The available equity capital is usually not sufficient and the difference is covered. You have the same rights as Swiss citizens to purchase real estate; you do not need a permit to purchase a house or land. UK nationals resident in Switzerland. Whatever your real estate project in Switzerland – buying, renting, selling Your dream home is waiting for you! It will only take a few clicks to. Why Buy Property in Switzerland? Switzerland is popular among the international community for the sense of reliability, stability and security it offers. Its. There are no restrictions for the purchase of residential real estate in Switzerland by EU citizens (permits B or C). Non-EU citizens need to wait for a. Find Property for sale in Switzerland. Search for real estate and find the latest listings of Switzerland Property for sale. When and how do you have to register a secondary residence in Switzerland? A second home must also be registered in Switzerland. It is therefore important. It all depends on what do you plan to rent or buy, and your cost of opportunity. You can get to different conclusions depending on your goals. Looking to buy a house or a chalet in Switzerland? Using the largest real estate search at astro-athena.ru you can quickly find just the right house. A financial check is the basis for purchasing your own home in Switzerland. The available equity capital is usually not sufficient and the difference is covered. You have the same rights as Swiss citizens to purchase real estate; you do not need a permit to purchase a house or land. UK nationals resident in Switzerland. Whatever your real estate project in Switzerland – buying, renting, selling Your dream home is waiting for you! It will only take a few clicks to. Why Buy Property in Switzerland? Switzerland is popular among the international community for the sense of reliability, stability and security it offers. Its. There are no restrictions for the purchase of residential real estate in Switzerland by EU citizens (permits B or C). Non-EU citizens need to wait for a. Find Property for sale in Switzerland. Search for real estate and find the latest listings of Switzerland Property for sale. When and how do you have to register a secondary residence in Switzerland? A second home must also be registered in Switzerland. It is therefore important. It all depends on what do you plan to rent or buy, and your cost of opportunity. You can get to different conclusions depending on your goals.

Buy a house: are you looking for a house to sale? ImmoScout24 has a large selection of houses for sale. Input a location for your search, then quickly and. Any person who is a Swiss citizen or possesses a B- or C-residence permit can purchase property in Switzerland. The cost of property remains expensive, with. But in Switzerland, the majority of people rent their homes. Only 47% of Swiss households own their home, which is the lowest rate in the EU. The average Swiss. Since , home buying in Switzerland has been regulated by the so-called “Lex Koller,” a law that applies throughout the country. It specifies the conditions. If you're an expat looking to buy property in Switzerland, you're in luck. The Swiss real estate market is one of the most stable in Europe and offers good. Affordability criteria for buying a home in Switzerland · To buy a home in Switzerland, you need at least 20% of the purchase price in cash. · To purchase a. You will find a number of search results when you seek a house in Switzerland. If you are looking for a house, we are ready to help you find your dream home. Houses for sale in Switzerland ✓ exclusive offers ✓ Buy a house in Switzerland with Engel & Völkers ✚ Start your search now! Discover more than properties for sale in Switzerland on Properstar. Find your dream home in Switzerland today. Legal Framework: Switzerland imposes restrictions on non-residents when it comes to buying property. The Lex Koller law, in particular, governs. Equity is a key factor. If you wish to become the owner of your main Swiss residence, you must contribute at least 20% of the purchase price (also called ". Usually this takes weeks and it would only be refused if you already own another property in Switzerland or the property does not comply with the rules. If. Tax on homeownership. If you are a homeowner in Switzerland, you have to pay income tax on the equivalent rental value of your property. On the other hand. The housing market in Switzerland is full of options, from traditional chalet houses to modern city center apartments. Should you rent or buy? Viewing 24 of Homes for Sale in Switzerland. Usually this takes weeks and it would only be refused if you already own another property in Switzerland or the property does not comply with the rules. If. Your destination for buying luxury property in Switzerland. Discover your dream home among our modern houses, penthouses and villas for sale. In fact, the culture of renting is so strong that in Switzerland, renting is more common than buying a home. According to the Swiss Federal Statistics Office. Buying property in Switzerland is often tricky for foreign nationals due to various laws and restrictions. The Lex Koller law dictates which permits are. If you want to buy a residential real estate in Switzerland as a place for your primary residence and you intend to stay here permanently for longer than

Arbor Realty Trust Inc Stock

(NYSE: ABR) Arbor Realty Trust stock price per share is $ today (as of Sep 13, ). ABR, Arbor Realty Trust - Stock quote performance, technical chart analysis, SmartSelect Ratings, Group Leaders and the latest company headlines. Stock Quote ; $, + (+%), 2,, Trading Statistics ; Stock Price. Open: ; Volume. Stock: 1,, ; Volatility. Today's Stock Vol: ; Corporate. Dividend: Nov $ (Est.). Arbor Realty Trust Inc FXDFR PFS PERPETUAL USD 25 - Ser F pays a dividend yield (FWD) of %. ISIN: US Arbor Realty Trust, Inc. operates as a real estate investment trust, which engages in the provision of loan origination and servicing for multifamily, seniors. Key Stats · Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change Arbor Realty Trust Reports Second Quarter Results and Declares Dividend of $ per Share · Arbor Realty Trust Schedules Second Quarter Earnings. Arbor Realty Trust Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - (NYSE: ABR) Arbor Realty Trust stock price per share is $ today (as of Sep 13, ). ABR, Arbor Realty Trust - Stock quote performance, technical chart analysis, SmartSelect Ratings, Group Leaders and the latest company headlines. Stock Quote ; $, + (+%), 2,, Trading Statistics ; Stock Price. Open: ; Volume. Stock: 1,, ; Volatility. Today's Stock Vol: ; Corporate. Dividend: Nov $ (Est.). Arbor Realty Trust Inc FXDFR PFS PERPETUAL USD 25 - Ser F pays a dividend yield (FWD) of %. ISIN: US Arbor Realty Trust, Inc. operates as a real estate investment trust, which engages in the provision of loan origination and servicing for multifamily, seniors. Key Stats · Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change Arbor Realty Trust Reports Second Quarter Results and Declares Dividend of $ per Share · Arbor Realty Trust Schedules Second Quarter Earnings. Arbor Realty Trust Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range -

Is Arbor Realty Trust Inc (NYSE:ABR) the Best Dividend Stock to Buy According to Billionaire Leon Cooperman? (Insider Monkey). Jun See the latest Arbor Realty Trust Inc stock price (ABR:XNYS), related news, valuation, dividends and more to help you make your investing decisions. Arbor Realty Trust Inc is listed in the Real Estate Investment Trust sector of the New York Stock Exchange with ticker ABR-D. The last closing price for. Trading Statistics ; Stock Price. Open: ; Volume. Stock: 1,, ; Volatility. Today's Stock Vol: ; Corporate. Dividend: Nov $ (Est.). Discover real-time Arbor Realty Trust Common Stock (ABR) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Given the current short-term trend, the stock is expected to fall % during the next 3 months and, with a 90% probability hold a price between $ and. Valuation · Arbor Realty Trust's EPS has decreased by 17% YoY and by 10% QoQ · The stock's price to earnings (P/E) is 6% more than its 5-year quarterly average of. Arbor Realty Trust: 3 Reasons A Dividend Cut Is Imminent. Aug. 17, AM ETArbor Realty Trust, Inc. (ABR) Stock, astro-athena.ruD Stock, astro-athena.ruE Stock, ABR. Arbor Realty Trust Inc. ; Volume, M ; Market Value, $B ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, %. ABR - Arbor Realty Trust, Inc. Stock - Stock Price, Institutional Ownership, Shareholders (NYSE). View Arbor Realty Trust Inc ABR stock quote prices, financial information, real-time forecasts, and company news from CNN. Arbor Realty Trust reports second quarter results and declares dividend of $ per share. Key Stock Data · P/E Ratio (TTM). (09/11/24) · EPS (TTM). $ · Market Cap. $ B · Shares Outstanding. M · Public Float. M · Yield. Arbor Realty Trust Inc is a specialized real estate finance company. It invests in a diversified portfolio of structured finance assets. Based on 4 Wall Street analysts offering 12 month price targets for Arbor Realty in the last 3 months. The average price target is $ with a high forecast. Arbor Realty Trust, Inc. (astro-athena.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Arbor Realty Trust, Inc. | Nyse: ABR. Stock analysis for Arbor Realty Trust Inc (ABR:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Arbor Realty Trust market cap as of September 02, is $B. Compare ABR With Other Stocks. Arbor Realty Trust, Inc. invests in a diversified portfolio of structured finance assets in the multifamily, single-family rental, and commercial real estate. The 26 analysts offering price forecasts for Arbor Realty Trust have a median target of , with a high estimate of and a low estimate of

Types Of Loans For Homeowners

year. Pay off your home twice as fast with a year fixed rate mortgage. Your rate stays the same throughout the life of the loan, giving you secure and. 1. Conventional Loans 2. Government Mortgages (Unconventional Loans) 3. Mortgages by Interest Rate Type 4. Other Types of Mortgage Loans. There are a variety of financing options available to first-time homebuyers—including conventional mortgages and government-backed loans from the Federal. Looking to buy or refinance your home? Contact a mortgage specialist at Fifth Third Bank to learn about mortgages, current mortgage rates, and loan types. There are two basic types of mortgages: fixed-rate mortgages and adjustable-rate mortgages. Your loan type will determine whether your interest rate and monthly. FHA's Single Family mortgage programs help prospective homebuyers and current homeowners finance or refinance a home for purchase, renovations or repairs. Housing Loans · Home Loan for Regular Purchase · Rural Housing: Farm Labor Housing Loans and Grants · Rural Housing Loans · Rural Housing: Housing Repair Loans and. Options for a Rental Property Loan · 1. Conventional · 2. FHA · 3. VA · 4. Portfolio · 5. Blanket · 6. Private · 7. Seller Financing · 8. HELOC. Common Types of Mortgages · Conventional Loans · Federal Housing Administration (FHA) Loans · U.S. Department of Veterans Affairs (VA) Loans. year. Pay off your home twice as fast with a year fixed rate mortgage. Your rate stays the same throughout the life of the loan, giving you secure and. 1. Conventional Loans 2. Government Mortgages (Unconventional Loans) 3. Mortgages by Interest Rate Type 4. Other Types of Mortgage Loans. There are a variety of financing options available to first-time homebuyers—including conventional mortgages and government-backed loans from the Federal. Looking to buy or refinance your home? Contact a mortgage specialist at Fifth Third Bank to learn about mortgages, current mortgage rates, and loan types. There are two basic types of mortgages: fixed-rate mortgages and adjustable-rate mortgages. Your loan type will determine whether your interest rate and monthly. FHA's Single Family mortgage programs help prospective homebuyers and current homeowners finance or refinance a home for purchase, renovations or repairs. Housing Loans · Home Loan for Regular Purchase · Rural Housing: Farm Labor Housing Loans and Grants · Rural Housing Loans · Rural Housing: Housing Repair Loans and. Options for a Rental Property Loan · 1. Conventional · 2. FHA · 3. VA · 4. Portfolio · 5. Blanket · 6. Private · 7. Seller Financing · 8. HELOC. Common Types of Mortgages · Conventional Loans · Federal Housing Administration (FHA) Loans · U.S. Department of Veterans Affairs (VA) Loans.

FHA loans have been helping people become homeowners since How do we do it? The Federal Housing Administration (FHA) - which is part of HUD - insures the. FHA mortgage loans are a common option for those with less-than-excellent credit and low income. They are also popular with borrowers buying their first home. Those with a steady income, who don't have other significant debts are the best candidates for a year, fixed-rate loan. Since the loan amount is shorter, the. 1. Conventional Mortgages · 2. Fixed-Rate Mortgages · 3. Adjustable-Rate Mortgages · 4. Government Loans a:FHA Loans b:USDA Loans c:VA Loans 5. Alternative mortgage options. Some eligible homebuyers may qualify for an FHA (Federal Housing Administration) or a VA (Department of Veterans Affairs) loan. Know the types of home loans · Fixed-Rate Mortgage · Adjustable-Rate Mortgage · FHA Loans · VA Loans · Jumbo Loans · Down Payment Assistance Programs · USDA Loans. In this article, we'll look at the options for getting a rental property loan and discuss how to analyze cash flow and property value to help you make the best. Types of mortgage loans · CONVENTIONAL LOANS. A · FIXED-RATE MORTGAGE. Most homeowners prefer fixed-rate mortgages because they offer the financial comfort of a. What are the types of home equity loans and lines of credit? · Fixed-rate home equity loans · Variable-rate HELOCs · HELOCs with conversion options. Some. View rates, learn about mortgage types and use mortgage calculators to help find the loan right for you. Prequalify or apply for your mortgage in minutes. Understanding Common Types of Mortgage Loans · Fixed-Rate Mortgage: This mortgage type has an interest rate that stays the same for the life of the loan. 1. Conventional Mortgages · Good credit · A down payment of at least 3% · A manageable debt-to-income ratio · Private mortgage insurance (PMI) for loans with a. Learn more about funding and financing opportunities – including CMHC's homeowner mortgage loan insurance programs and eligibility requirements. Hazard insurance and, if applicable, flood insurance are required on collateral property. Actual rates, fees, and terms are based on those offered as of the. Down payment as low as 3% on a conventional conformingOpens Dialog fixed-rate mortgage. Allows the use of gift funds and down payment assistance programs. With. There are two basic types of mortgages: fixed-rate mortgages and adjustable-rate mortgages. Your loan type will determine whether your interest rate and monthly. Home mortgage loans are offered by lenders to qualifying borrowers. A borrower pays back the home loan over an agreed length of time called a “term”. The closing cost credit is not available with all loan types. Please speak with a home mortgage consultant for details. 6. Not all assets qualify. For more. Terms and conditions may apply. Property insurance is required on all loans secured by property. VA loan products are subject to VA eligibility requirements. Loans designed to support homeowners to increase energy and water efficiency, reduce utility costs, and create a more healthy and sustainable home. Learn more.